Page 27 - 全球能源互联网资讯-第10期(12月)-英文

P. 27

In-depth Analysis NO.10 2020 / 12

market. These fiscal stimuli Percentage (%)

expanded government budgets

and led to further increases in

government debt levels. The

U.S. stimulus package is huge,

with USD 2.6 trillion in stimulus

spending and USD 900 billion Financial Crisis

in tax relief. In addition, since

September 2019, the FED Dot-com bubble

has added USD 454 billion in

liabilities, bringing the size of

its balance sheet, which has

increased by USD 3.4 trillion, to

USD 7.15 trillion.

High global debt levels will be a

hindrance to economic recovery.

According to the Institute of

International Finance (IIF), global U.S. Unemployment Rate Statistics

debt has increased by USD 70

trillion over the past 10 years, reaching a projected market, effectively stopping the market's continued

USD 258 trillion by the end of the first quarter of decline. The Dow Jones Industrial Average (DJIA),

2020. This is equivalent to 331% of global GDP, with Nasdaq, and S&P 500 then rallied quickly, even to

debt in mature markets reaching 392%. With high new all-time highs, demonstrating the market's

debt levels, the global economy is dependent on low confidence in Open for Business, supported by the 25

interest rates. Raising interest rates will mean an liquidity provided by stimulus funds.

increase in the government budget. The U.S. national Future economic direction

debt clock shows that government debt has reached The Federal Reserve forecasts median GDP

137% of GDP. Each 1% increase in interest rates would growth of 4.0% in 2021. Currently, the FED does

result in an increase of nearly USD 270 billion in the not expect to raise interest rates until the end of

annual government budget deficit, equivalent to a 6% 2021, and the long-term interest rate target will be

increase in the annual government budget prior to the kept between 2% and 3%. Goldman Sachs Group's

2019 pandemic. forecast figures are more optimistic: the U.S.,

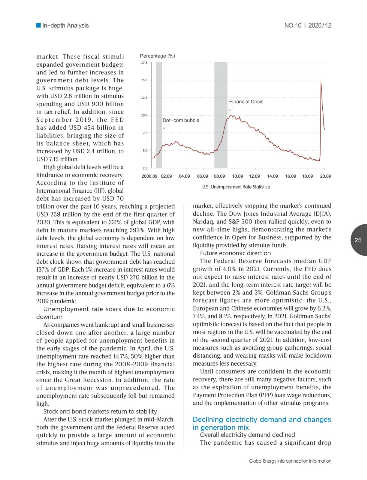

Unemployment rate soars due to economic European and Chinese economies will grow by 6.2%,

downturn 7.4%, and 8.1%, respectively, in 2021. Goldman Sachs'

As companies went bankrupt and small businesses optimistic forecast is based on the fact that people in

closed down one after another, a large number most regions in the U.S. will be vaccinated by the end

of people applied for unemployment benefits in of the second quarter of 2021. In addition, low-cost

the early stages of the pandemic. In April, the U.S. measures such as avoiding group gatherings, social

unemployment rate reached 14.7%, 50% higher than distancing, and wearing masks will make lockdown

the highest rate during the 2008-2009 financial measures less necessary.

crisis, making it the month of highest unemployment Until consumers are confident in the economic

since the Great Recession. In addition, the rate recovery, there are still many negative factors, such

of unemployment was unprecedented. The as the expiration of unemployment benefits, the

unemployment rate subsequently fell but remained Payment Protection Plan (PPP) loan wage reductions,

high. and the implementation of other stimulus programs.

Stock and bond markets return to stability

After the U.S. stock market plunged in mid-March, Declining electricity demand and changes

both the government and the Federal Reserve acted in generation mix

quickly to provide a large amount of economic Overall electricity demand declined

stimulus and inject huge amounts of liquidity into the The pandemic has caused a significant drop

Global Energy Interconnection Information